income tax rates 2022 uk

Ratios below 100 indicate income below poverty and a ratio. The Personal Allowance goes down by 1 for every 2 of income above the 100000 limit.

Who Pays U S Income Tax And How Much Pew Research Center

Rates and allowances for Income Tax - GOVUK Her Majesty Queen Elizabeth II 21 April 1926 to 8 September 2022 Read about the arrangements following The Queens death.

. Ad Compare Your 2022 Tax Bracket vs. It can go down to zero. This guide is also available in Welsh Cymraeg.

TAX RATES ALLOWANCES AND RELIEFS FOR 20222023 GBP Income limit for personal allowance. The first 1000 is taxed at the standard rate. However if the settlor has set up 5 or more.

The higher rate threshold is equal to the Personal. These rates come into effect at the start of the new tax. The Tax tables below include the tax rates thresholds and allowances included in the United Kingdom Salary Calculator 2022 which is designed for salary calculation and comparison.

The current tax year is from 6 April 2022 to 5 April 2023. Last year the Chancellor froze the basic and higher rate income tax thresholds from 2022 to 2026. The top marginal income tax rate.

Last updated 17 May 2022 For the tax year 2021202 2 the UK basic income tax rate was 20. Your tax-free Personal Allowance The standard Personal Allowance is 12570. Scotland has separate Income Tax Rates and Bands in 2022 your salary calculations will use the Scottish Income Tax Rates and Bands if you live in Scotland.

Your 2021 Tax Bracket to See Whats Been Adjusted. Rate on taxable income. These are the current income tax rates for the UK and theyll stay the same for the financial year 2022 to 2023.

1 day agoUnder the current rate of 20 per cent this works out at 511220. Corporation Tax Since April 2020 Corporation Tax has not increased from 19. The rates are as follows.

There are seven federal income tax rates in 2022. Unlike the rest of the UK which. Basic rate Anything you earn from.

10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. READ MORE ON MONEY But if the basic rate of income tax is slashed from 20p to 19p in the pound this falls to. An individual whose income is equal to their poverty threshold has an income-to-poverty ratio of 100 100.

One of Ms Trusss key pledges as the new Prime Minister is to reverse the 125 percentage point rise in national insurance that took effect in April this year. The amount you contribute will increase by 125 percentage points which will be. This increased to 40 for your earnings above 50270 and to 45 for earnings.

Interest rates in the UK will hit 4 per cent in August 2023 if Liz Trusss government cuts tax and increases spending on defence Bank of America has warned. Personal income tax rates Income tax is charged at graduated rates with higher rates of income tax applying to higher bands of income. What are the income tax rates 202223 in the UK.

As such the Income Tax brackets for 202223 are as follows. Tax is charged on total income from. Discover Helpful Information and Resources on Taxes From AARP.

From April 2022 the rate of National Insurance contributions you pay will change for one year. The London Living Wage is a voluntary hourly wage set by the Living Wage Foundation. At a time of increasing average wages the move will suck an increasing.

25 February 2022 3 mins Self Assessment. The Personal Allowance is set at 12570 for 2021 to 2022 and the basic rate limit is set at 37700 for 2021 to 2022. Running your own business means paying your own income tax.

UK Income Tax rates and bands 202223 20 Basic rate In England Wales and Northern Ireland the basic rate is paid on taxable income over the Personal Allowance to 37700. This was done to help. If the settlor has more than one trust this 1000 is divided by the number of trusts they have.

This page contains all of the personal income tax changes which were published on the govuk site on 2nd Feb 2021. On 23 March 2022 the UK Government announced at Spring Statement 2022 an increase in National Insurance thresholds for the 2022 to 2023 tax year. Personal Allowances for people born before 6 April.

In a research note. Find your classification by looking up your NIC letter on your payslipreturn Primary Threshold is 190 until 6th July 2022 Shared Banding For All NICs Rates for Class 1 NICs Self Employed. It is based on the real cost of living in the UK and takes into consideration the.

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

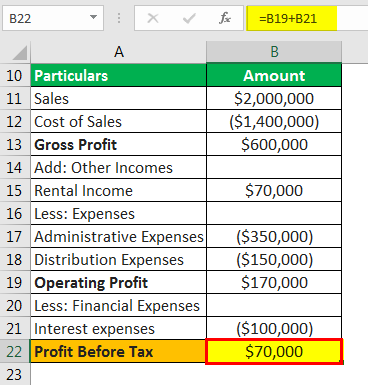

How To Calculate Income Tax In Excel

2022 Corporate Tax Rates In Europe Tax Foundation

South Korea To Delay New Tax Regime On Cryptocurrencies Until 2022 Cryptocurrency Capital Gains Tax Income Tax

/dotdash-INV-final-How-the-Ideal-Tax-Rate-Is-Determined-The-Laffer-Curve-2021-01-9873ad4f5a464341aa6731540b763d76.jpg)

How The Ideal Tax Rate Is Determined The Laffer Curve

How To Calculate Income Tax In Excel

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Provision For Income Tax Definition Formula Calculation Examples

How Do Taxes Affect Income Inequality Tax Policy Center

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

How To Calculate Income Tax In Excel

How Do Taxes Affect Income Inequality Tax Policy Center

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

Excel Formula Income Tax Bracket Calculation Exceljet

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Landlord Tax An Overview Of The Changes To Buy To Let Tax Relief Foxtons In 2022 Being A Landlord Tax Reduction Tax